Facebook has finally decided to launch IPO with the price range between $ 28 to mid $ 35. World's largest social networking website will start trading on Nasdaq exchange on May 18, according to S-1 filing from the company

Facebook plans to raise as much as $12 billion in Silicon Valley's largest IPO, dwarfing the coming-out parties of tech companies like Google and granting the world's largest social network a market value close to Amazon.com's.

The company also released video of its road show, set to start on Monday, online. (Click to watch the video.)

Facebook plans to invest heavily in mobile, even if the payoff takes a long time or is uncertain, Chief Financial Officer David Ebersman says in the video. Chief Operating Officer Sheryl Sandberg adds that mobile is a key growth area for the company.

The eight-year-old social network that began as Mark Zuckerberg's Harvard dorm room project priced its initial public offering at between $28 and $35 a share on Thursday, attaining a valuation of as much as $95.9 billion at the high end. Shares are expected to be priced the evening of May 17, with trading beginning on May 18.

If an over-allotment or "greenshoe" option is triggered, the company could end up raising close to $13.6 billion, according to a Thursday prospectus.

Investors are expected to flock to the highly anticipated IPO, though some have voiced concerns about the social network's longer-term growth

Last week, Facebook reported its first quarter-to-quarter revenue slide in at least two years, a sign that the social network's sizzling growth may be cooling just as it prepares to go public. Its stock should begin trading in about a week or two.

Facebook, which plans to list its stock on the Nasdaq under the ticker "FB", will begin meeting with investors on Monday.

LinkedIn Is Buying SlideShareBY

LinkedIn has just announced it plans to acquire San Francisco-based startup SlideShare for about $119 million. Founded in 2006, SlideShare is a web-based hub for people to store and share presentations. LinkedIn's announcement frames it as a way for "professionals to discover people through content, and content through people." "Presentations are one of the main ways in which professionals capture and share their experiences and knowledge, which in turn helps shape their professional identity," LinkedIn CEO Jeff Weiner said in the announcement, adding that they help people "discover new connections and gain the insights they need to become more productive and successful in their careers."

EBay Wants To Build NYC's Second-Largest Developer SpaceBY.

eBay just snapped up a massive 35,000 square foot NYC space that will house more than 200 developers when it opens this fall. Hunch founder Chris Dixon, who sold the company to eBay in November, will lead the team of developers and data scientists to further build out eBay's recommendation system. The space will also offer free working space for "friends of eBay" startups. Dixon told GigaOM he hopes eBay will become the second-largest developer space in New York after Google's, which currently employs more than 1,000 workers. EBay joins the roster of big-company developer niches in New York, which also includes Facebook, Twitter, and now Microsoft.

Walmart's "American Idol" Contest Has A Winner

Walmart's "American Idol" Contest Has A Winner

WalmartLabs, Walmart's online R&D arm, launched an American Idol style popularity contest online in March this year. Anyone could suggest products they wanted to see on Walmart's shelves, and customers could vote for their favorites. The Get On The Shelf contest gathered over a million votes for 4000 entries, including choice suggestions like a baby-proof toilet cover (to prevent kids from falling in), an in-nappy garbage bag (for less of a mess), a hot dog slicer, and a tuna squisher. Practical as these entries may be, Walmart's grand prize winner, announced today, has a socially conscious agenda: HumanKind Water gives away its net profits on sale of bottled water to countries which lack clean drinking water.

Pinterest Is Signing Up Translators to reach global audience.

Pinterest is looking for help taking its Midwest-led, hyper-addictive virtual pinboarding frenzy global. The company posted an ad late yesterday calling for translators to help translate Pinterest into other languages, and could speakers of one or more foreign tongues sign up with a dab of information? The company explained that they're starting in earnest with French, German, Japanese, Portugese and Spanish, but welcome help with Arabic, Danish, Dutch, Farsi, Filipino, Finnish, Hebrew, Hindi, Hungarian, Indonesian, Italian, Korean, Malay, Norwegian, Polish, Simplified Chinese, Swedish, Thai, Traditional Chinese, Turkish, and Urdu.

Microsoft Research Opens a research lab in NYC.

Microsoft is opening a research lab in NYC, and looking to partner with universities like Columbia U, NYU and others in the area. Their first crop of hires are 15 ex-Yahoo researchers and data fiends of various flavors, including network theorist and social media researcher Duncan Watts. In early April, Yahoo announced it would be laying off 2000 employees. The NYC office will be led by Microsoft Research HQ based in Cambridge, MA, which hosts Web and internet culture research celebs like Gen-Fluxer danah boyd (her annnouncement here).

Pinterest Is Signing Up Translators to reach global audience.

Pinterest is looking for help taking its Midwest-led, hyper-addictive virtual pinboarding frenzy global. The company posted an ad late yesterday calling for translators to help translate Pinterest into other languages, and could speakers of one or more foreign tongues sign up with a dab of information? The company explained that they're starting in earnest with French, German, Japanese, Portugese and Spanish, but welcome help with Arabic, Danish, Dutch, Farsi, Filipino, Finnish, Hebrew, Hindi, Hungarian, Indonesian, Italian, Korean, Malay, Norwegian, Polish, Simplified Chinese, Swedish, Thai, Traditional Chinese, Turkish, and Urdu.

Microsoft Research Opens a research lab in NYC.

Microsoft is opening a research lab in NYC, and looking to partner with universities like Columbia U, NYU and others in the area. Their first crop of hires are 15 ex-Yahoo researchers and data fiends of various flavors, including network theorist and social media researcher Duncan Watts. In early April, Yahoo announced it would be laying off 2000 employees. The NYC office will be led by Microsoft Research HQ based in Cambridge, MA, which hosts Web and internet culture research celebs like Gen-Fluxer danah boyd (her annnouncement here).

After The U.K. Censors It, Pirate Bay Site Sees Traffic Boom

Just the other day the torrent-source website Pirate Bay saw 12 million more daily visitors than it has ever had before. The news comes in the immediate aftermath of a U.K. High court decision to order local ISPs to block access to Pirate Bay's site, and it looks like some--such as Virgin Media--have already complied. A site spokesman is quoted as thanking the British Phonographic Institute, responsible for pressuring the courts to enforce the ban, for free advertising that rapidly spread throughout Europe. In the interim period between the decision and broad site-blocking, the site is said to plan educational tips for users on how to circumvent the ban. The move illustrates the technical complexities of trying to enforce blocks on parts of the Internet, and comes just as the high court in Pakistan rules that censoring the Internet is actually illegal.

MIT And Harvard Team Up For Online Education Platform EdX

MIT And Harvard Team Up For Online Education Platform EdX

MIT and Harvard are partnering up for a new online educational initiative. The brand new edX non profit builds on the MITx online course series that MIT launched in March this year (MITx is now a part of edX). "Anyone with an internet connection anywhere in the world can have access," Harvard president Drew Faust said at a press conference today. The two universities plan to collaborate with other universities across the country to offer online learning tools "on a single site," she added. The platform will start out hosting courses from MIT and Harvard, but will also help educators develop online learning technology and tools for distance learning. "Our goal is to educate a billion people around the world," head of MITx, Anant Agarwal, said in an introductory video. edX will be collecting data about how students learn online, and offer that data set to researchers building tools. Agarwal will lead edX as its first president. Agarwal said that Sal Khan, "a student of many of us here," was a leader in the field of online education, and his distinctive video style at Khan Academy did influence the way MITx and edX was designed. MITx itself shot off to hot start--its first online course on circuits received 120,000 registrations when it launched, MIT president Susan Hockfield said today.

Nokia has just announced that it's pressing lawsuits in the U.S. and Germany against rival phone makers HTC and RIM, plus Viewsonic for violating "a number" of patents it owns. Nokia's press statement argues that the move is "to protect its innovations and intellectual property," and only comes after what seem to be failed licensing talks--the firm's chief legal officer is quoted saying "We have already licensed our standards essential patents to more than 40 companies. Though we'd prefer to avoid litigation, Nokia had to file these actions to end the unauthorized use of our proprietary innovations and technologies, which have not been widely licensed." Specifically the IP covers dual-function antennas, power mangement and multimode radios and enhancements to application stores, multitasking, and a short list of other services that sound typical on current smartphones. Nokia was once king of cell phones, but recently saw its crown stolen by Samsung, and also Apple in terms of smartphone sales.

Instagram Hitting 50 Million Users About Now

According to some pretty simple math, Instagram's user base is topping 50 million people about now, a mere handful of days since it was sold to Facebook for a staggering billion-dollar price. Considering at the start of this year the user count was only around 15 million, this represents staggering growth. Some of this growth has come from the new Android compatibility (that caused such a rapid uptick in numbers it may have spurred the Facebook buyout), but as Mashable notes it seems that since this event the growth in numbers has been roughly shared by iPhone users and Android owners.

Spotify Launches An iPad App

Social music streaming service Spotify has finally released an app for the iPad, accessible to subscribers of its paid Premium service. The app has been a long time coming, as almost all its music streaming competitors seem to have an app out already. It was expected to surface at the recent Ad Age conference in New York City, but CEO Daniel Ek announced various app and big-name advertising partnerships instead. But then again, Spotify seems to be making quite the habit of late releases--the service itself only became available in the U.S. last summer, well after it was a hit in Europe.

Twitter's First University Collaboration, To Co-teach Berkeley Data Course

In its first partnership with a university, Twitter is sending engineers to advise a data class for computer science students at UC Berkeley this fall. Students will learn how to manipulate real Twitter data and build apps for the social netwok, something companies like Bluefin Labs tackle in earnest. The class, Analyzing Big Data With Twitter, is led by computer scientist and Berkeley faculty member Marti Hearst. Twitter is also inviting students to present their final projects at Twitter's HQ at the end of the course.

Baby Naming Gets Social, With Facebook-Linked Name Maker App.

The Central Baptist Hospital in Lexington Kentucky just had a Baby Name Generator app constructed for it, designed to help expectant mothers work out the "world's most perfect" or merely "super-cute" names. Its code centers on social media influencers, tech starts, sci-fi characters, notable vampires and so on...and once you've juggled together the world's most SEO-able, Klout-friendly name you can pin it on a virtual blanket and then pin that to Pinterest or share it on Twitter, Facebook and so on. And if you can't decide yourself, the app even lets your Facebook friends crowdsource a name for you by voting on your potential choices. Silly, but fun...and actually taps into an interesting social idea--that our future children's names could be more dynamic than historically typical. At the time of writing, the most shared name was "Schwarzenneger Churchill Ted," for a child that would seem destined for greatness.

Boeing handed over the ceremonial keys of a new 747-8 Intercontinental to Lufthansa Tuesday in what will be the new longest passenger airliner in the skies. The aircraft is the stretched version of the popular 747-400 series Lufthansa currently flies.

The new Boeing jet will enter service at the beginning of June on the Frankfurt to Washington Dulles International Airport route. It features redesigned business and first class cabins that are more luxurious than its predecessor.

"We are excited and thrilled to welcome the 747-8 Intercontinental to our fleet," Lufthansa Chief Executive Carsten Spohr says in a release. "And our passengers will love the new interior, which includes our all-new full-flat business-class cabin."

So far no U.S. airline has placed orders for the stretched and now longest commercial airliner, which measures a little more than 250 feet — more than 18 feet longer than its predecessor.

Until the introduction of this aircraft, Lufthansa lagged behind most of the other major international airlines in offering a business class seat that converts into a fully horizontal bed. At the press of a button, the seat converts into the lie-flat position that measures about 6.5 feet long.

The seats themselves are arranged in a "V" formation allowing for greater shoulder room between seatmates. Other improved features in business class include additional storage space and a much larger, 15-inch individual entertainment screen at each seat.

Unlike the 747-400 where first class was upstairs, that class will be located in the nose of the aircraft on the main deck. The seats in this cabin also convert into fully horizontal beds as shown to the left.

The aircraft seats a total of 362 passengers: eight in first class, 92 in business class and 262 in economy.

Lufthansa ordered 20 of the 747-8, five of which will be delivered this year. As more aircraft come online, they will be deployed on additional routes to Chicago, Los Angeles, New Delhi and Bangalore.

The final guidelines on Basel III capital regulations are enclosed. These guidelines would become effective from January 1, 2013 in a phased manner.

The Basel III capital ratios will be fully implemented as on March 31, 2018.

1 of 1 File(s)

The Basel III capital ratios will be fully implemented as on March 31, 2018.

1 of 1 File(s)

Do Cash Holdings Impact Funds' Performance?

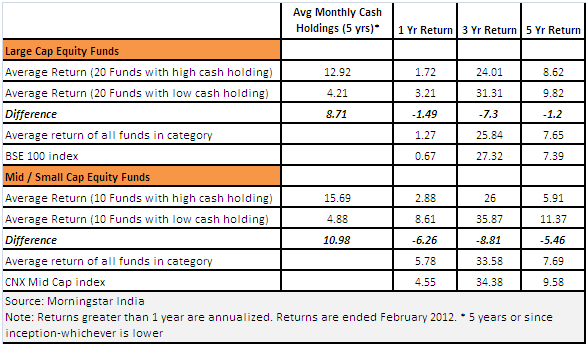

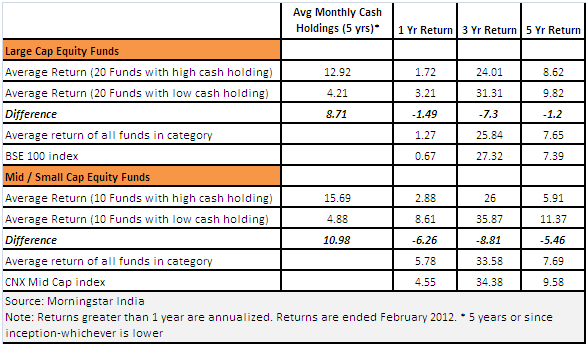

Morningstar India recently published a joint study with the Hyderabad-based Indian School of Business to examine the impact of mutual funds' cash holdings on their overall performance.

The debate over the benefits of large cash holdings by actively managed funds has been ongoing for a long time. We try to delve deeper and check if equity funds in India observe better performance when holding higher cash during market downturns; or do they end up missing out on sudden upturns in the market.

In India, fund houses like Escorts, Reliance, Sahara and Taurus are known, within the industry, to take cash calls from time to time, with cash holdings in excess of 20% on many occasions. It should be noted here that the excess cash holdings played out mostly in the period of 2008-09, when the financial crisis was underway- taking its toll on markets. Post that period, cash calls by most funds have tempered down substantially—but then again, so has the adversity in stock markets. On the other hand, fund houses like Fidelity, Franklin Templeton, HDFC and Tata have maintained lower cash holdings, ranging between 4-8% over the past five- year period, across most of their funds.

Taking two categories of equity funds, Large Cap and Small & Mid Cap, we compare the highest cash holding funds with the lowest cash holding funds (See Table). In the case of large cap funds, the top 20 funds with high cash holding funds, held about 9% more cash on average, than the bottom 20 cash holding funds over the past five years, but have earned about 1.2% lower returns (annualized) than them, over the same period. The performance is particularly poor over a 3 year period, where their returns are about 7% lower than those funds with lesser cash holdings, within the large cap category.

We find a similar pattern in the case of Small & Mid Cap funds—although much starker. It seems that the top ten funds with the highest cash holding within this category, earned about 5.5% less (annualized) than the bottom ten funds with lower cash holding, over a five year period. Over a three- and one-year period, they earned approximately 9% (annualized) and 6% lesser, respectively.

Cash also seems to have a varying impact, depending on the category of fund. Large cap funds, by virtue of investing in more large and liquid stocks, are able to buy and sell the shares quickly, and hence the role of cash becomes less important. On the other hand, in the case of small/mid cap funds, keeping excess cash might mean losing out on an upswing, as the lower liquidity of these shares would result in the prices zooming up due to sudden demand. The vice-a-versa is also true. That is, in the case of illiquid stocks, selling might not be easy when there is a redemption pressure or a downturn. This probably explains the higher historical average cash holdings, of mid cap funds, when compared to their large cap peers.

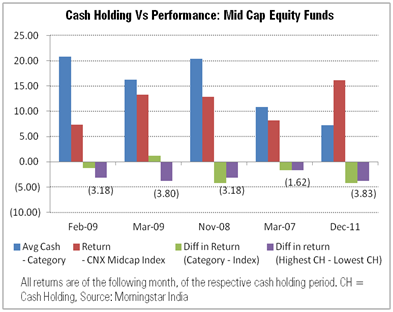

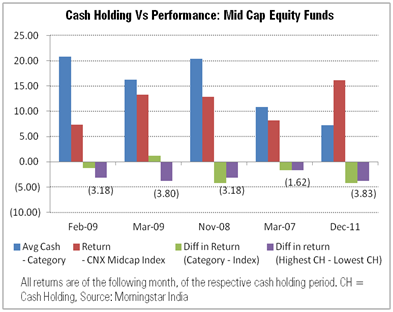

We observe that the key risk in taking cash calls lies in deploying it at the right time. Fund managers often miss out on a sudden upturn, as is evident from the graphs below for large cap funds and mid cap funds. Clearly higher cash holdings have resulted in lower fund returns in the following months, especially when the markets have turned around very suddenly. Again, here the impact seems to be starker within the small/mid cap fund category, where there are instances when the funds with high cash holdings have underperformed those funds with lowest cash holdings, by more than 3% (on average) in the following month.

On a closing note, besides the cash holding, there are other important factors too, which have a bearing on the performance—like the quality of the fund management team, the processes in place etc. However, avoiding high cash calls, and remaining more invested across market cycles, does point towards a more disciplined approach towards investing. Moreover, it helps to neutralize the risk of being caught on the wrong foot, especially in event of a sudden upswing in markets. As legendary fund manager Peter Lynch once said—"Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves."

The debate over the benefits of large cash holdings by actively managed funds has been ongoing for a long time. We try to delve deeper and check if equity funds in India observe better performance when holding higher cash during market downturns; or do they end up missing out on sudden upturns in the market.

In India, fund houses like Escorts, Reliance, Sahara and Taurus are known, within the industry, to take cash calls from time to time, with cash holdings in excess of 20% on many occasions. It should be noted here that the excess cash holdings played out mostly in the period of 2008-09, when the financial crisis was underway- taking its toll on markets. Post that period, cash calls by most funds have tempered down substantially—but then again, so has the adversity in stock markets. On the other hand, fund houses like Fidelity, Franklin Templeton, HDFC and Tata have maintained lower cash holdings, ranging between 4-8% over the past five- year period, across most of their funds.

Taking two categories of equity funds, Large Cap and Small & Mid Cap, we compare the highest cash holding funds with the lowest cash holding funds (See Table). In the case of large cap funds, the top 20 funds with high cash holding funds, held about 9% more cash on average, than the bottom 20 cash holding funds over the past five years, but have earned about 1.2% lower returns (annualized) than them, over the same period. The performance is particularly poor over a 3 year period, where their returns are about 7% lower than those funds with lesser cash holdings, within the large cap category.

We find a similar pattern in the case of Small & Mid Cap funds—although much starker. It seems that the top ten funds with the highest cash holding within this category, earned about 5.5% less (annualized) than the bottom ten funds with lower cash holding, over a five year period. Over a three- and one-year period, they earned approximately 9% (annualized) and 6% lesser, respectively.

Cash also seems to have a varying impact, depending on the category of fund. Large cap funds, by virtue of investing in more large and liquid stocks, are able to buy and sell the shares quickly, and hence the role of cash becomes less important. On the other hand, in the case of small/mid cap funds, keeping excess cash might mean losing out on an upswing, as the lower liquidity of these shares would result in the prices zooming up due to sudden demand. The vice-a-versa is also true. That is, in the case of illiquid stocks, selling might not be easy when there is a redemption pressure or a downturn. This probably explains the higher historical average cash holdings, of mid cap funds, when compared to their large cap peers.

We observe that the key risk in taking cash calls lies in deploying it at the right time. Fund managers often miss out on a sudden upturn, as is evident from the graphs below for large cap funds and mid cap funds. Clearly higher cash holdings have resulted in lower fund returns in the following months, especially when the markets have turned around very suddenly. Again, here the impact seems to be starker within the small/mid cap fund category, where there are instances when the funds with high cash holdings have underperformed those funds with lowest cash holdings, by more than 3% (on average) in the following month.

On a closing note, besides the cash holding, there are other important factors too, which have a bearing on the performance—like the quality of the fund management team, the processes in place etc. However, avoiding high cash calls, and remaining more invested across market cycles, does point towards a more disciplined approach towards investing. Moreover, it helps to neutralize the risk of being caught on the wrong foot, especially in event of a sudden upswing in markets. As legendary fund manager Peter Lynch once said—"Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves."

• Could Savient Pharmaceuticals, Inc. (SVNT) Really be Bankrupt? More...

• Pfizer Inc. (PFE) Pays $450 Million to Brigham Young University Over Celebrex Spat More...

• Novaliq Receives E3.9 Million in Further Round of Financing Talks More...

• Pfizer Inc. (PFE) Races to Reinvent Itself, Hunts for Mid-size Drug DealsMore...

• Synexus Further Strengthens Its Presence in Poland with the Acquisition of Osteomed More...

• Axerion Therapeutics, AstraZeneca PLC (AZN) Inks Pact to Combat Alzheimer's Disease More...

• Gentium S.p.A. Appoints PharmaSwiss, S.A. as Exclusive Distributor of Defibrotide in Central and Eastern European Countries More...

• Evotec AG (EVTG.F) Grants Exclusive Rights on EVT 401 in China to Conba Pharmaceutical More...

• Nanobiotix and Thomas Jefferson University Start Research Collaboration More...

• Trevena, Inc. Enters Research Collaboration with Merck & Co., Inc. (MRK) To Identify Novel Biased Ligand Molecules More...

• Synergy Pharmaceuticals Appoints Gail M. Comer, M.D. as Chief Medical Officer More...

• Oxford BioTherapeutics Appoints Senior Industry Leader to Head its New Clinical Development Operations in Basel, Switzerland More...

• Althea Technologies, Inc. Appoints Dr. Kristin DeFife, Director, Biologics Manufacturing And Jack Wright, VP, Sales and Marketing More...

• Kevin C. O'Boyle Joins Durata Therapeutics, Inc. ' Board of Directors More...

• Knopp Biosciences Announces Recruiting of Key Scientific Executives and Completion of Laboratory Expansion More...

• Acura Pharmaceuticals, Inc. (ACUR) Announces First Quarter 2012 Financial Results More...

• Agennix AG Schedules Conference Call on May 9 to Discuss First Quarter 2012 Financial Results More...

• Amarin Corporation PLC (AMRN) to Report First Quarter 2012 Financial Results and Host Conference Call on May 8, 2012 More...

• AMAG Pharmaceuticals, Inc. (AMAG) Announces First Quarter 2012 Financial Results More...

• Arena Pharmaceuticals, Inc. (ARNA) Announces First Quarter 2012 Financial Results and Recent Developments More...

• Eli Lilly and Company (LLY) Invests in UK Research Base More...

• AVEO Pharmaceuticals, Inc. (AVEO) Lung Cancer Drug Fails Phase II Study More...

• Novartis AG (NVS) Drug for Smoker's Cough Boosts Lung Function in Study More...

• Novo Nordisk A/S (NVO) Says Blood Drugs Could Hold Blockbuster Potential More...

• Gilead Sciences, Inc. (GILD) Initiates Phase 3 Clinical Trial Evaluating GS-1101 for the Treatment of Chronic Lymphocytic Leukemia More...

• NovaBay Pharmaceuticals, Inc.'s Aganocide Out-Performed Traditional Antibiotics in Drug Resistance Study More...

• Pfizer Inc. (PFE), Protalix Biotherapeutics, Inc. (PLX) Wins FDA Nod for Gaucher Disease Drug; Genzyme Corporation (GENZ) Faces Competition More...

• MEDA's Dymista Approved by the FDA More...

• Acella Pharmaceuticals, LLC, Announces Approval of Generic Gabapentin Oral Solution More...

• Zogenix, Inc. Submits New Drug Application (NDA) to U.S. Food and Drug Administration (FDA) for Zohydro(TM) for Treatment of Chronic Pain More...

• Janssen Research & Development Submits XARELTO® (rivaroxaban) to U.S. FDA for the Treatment and Prevention of Recurrent Venous Thromboembolism More...

• A Woman's Intense Interest in Her Partner Shifts When Grandchildren Arrive,University of Oxford Study More...

• Fish Oil Doesn't Cut Failure Rate of Hemodialysis Grafts, Lawson Health Research Institute Study More...

• Computer Use and Exercise Combo May Reduce the Odds of Having Memory Loss, Mayo Clinic Study More...

• Vitamin D Blood Level for Reducing Major Medical Risks in Older Adults Identified, University of Washington Study More...

• Advanced Cell Technology Announces Massachusetts Eye and Ear as Additional Site for Clinical Trial for Dry Age-Related Macular Degeneration Using Human Embryonic Stem Cell-Derived RPE Cells More...

• Biodel Inc. (BIOD)'s Intellectual Property Position Strengthened for Ultra-Rapid-Acting Insulin Programs by Notice of Intent to Grant from European Patent Office More...

• Entia Biosciences Launches Medical Food for Treatment of Rheumatoid Arthritis More...

• Bioniche Life Sciences Inc. (BNC) Commercializing Two Products for Canine Cancer More...

• Pfizer Inc. (PFE) Pays $450 Million to Brigham Young University Over Celebrex Spat More...

• Novaliq Receives E3.9 Million in Further Round of Financing Talks More...

• Pfizer Inc. (PFE) Races to Reinvent Itself, Hunts for Mid-size Drug DealsMore...

• Synexus Further Strengthens Its Presence in Poland with the Acquisition of Osteomed More...

• Axerion Therapeutics, AstraZeneca PLC (AZN) Inks Pact to Combat Alzheimer's Disease More...

• Gentium S.p.A. Appoints PharmaSwiss, S.A. as Exclusive Distributor of Defibrotide in Central and Eastern European Countries More...

• Evotec AG (EVTG.F) Grants Exclusive Rights on EVT 401 in China to Conba Pharmaceutical More...

• Nanobiotix and Thomas Jefferson University Start Research Collaboration More...

• Trevena, Inc. Enters Research Collaboration with Merck & Co., Inc. (MRK) To Identify Novel Biased Ligand Molecules More...

• Synergy Pharmaceuticals Appoints Gail M. Comer, M.D. as Chief Medical Officer More...

• Oxford BioTherapeutics Appoints Senior Industry Leader to Head its New Clinical Development Operations in Basel, Switzerland More...

• Althea Technologies, Inc. Appoints Dr. Kristin DeFife, Director, Biologics Manufacturing And Jack Wright, VP, Sales and Marketing More...

• Kevin C. O'Boyle Joins Durata Therapeutics, Inc. ' Board of Directors More...

• Knopp Biosciences Announces Recruiting of Key Scientific Executives and Completion of Laboratory Expansion More...

• Acura Pharmaceuticals, Inc. (ACUR) Announces First Quarter 2012 Financial Results More...

• Agennix AG Schedules Conference Call on May 9 to Discuss First Quarter 2012 Financial Results More...

• Amarin Corporation PLC (AMRN) to Report First Quarter 2012 Financial Results and Host Conference Call on May 8, 2012 More...

• AMAG Pharmaceuticals, Inc. (AMAG) Announces First Quarter 2012 Financial Results More...

• Arena Pharmaceuticals, Inc. (ARNA) Announces First Quarter 2012 Financial Results and Recent Developments More...

• Eli Lilly and Company (LLY) Invests in UK Research Base More...

• AVEO Pharmaceuticals, Inc. (AVEO) Lung Cancer Drug Fails Phase II Study More...

• Novartis AG (NVS) Drug for Smoker's Cough Boosts Lung Function in Study More...

• Novo Nordisk A/S (NVO) Says Blood Drugs Could Hold Blockbuster Potential More...

• Gilead Sciences, Inc. (GILD) Initiates Phase 3 Clinical Trial Evaluating GS-1101 for the Treatment of Chronic Lymphocytic Leukemia More...

• NovaBay Pharmaceuticals, Inc.'s Aganocide Out-Performed Traditional Antibiotics in Drug Resistance Study More...

• Pfizer Inc. (PFE), Protalix Biotherapeutics, Inc. (PLX) Wins FDA Nod for Gaucher Disease Drug; Genzyme Corporation (GENZ) Faces Competition More...

• MEDA's Dymista Approved by the FDA More...

• Acella Pharmaceuticals, LLC, Announces Approval of Generic Gabapentin Oral Solution More...

• Zogenix, Inc. Submits New Drug Application (NDA) to U.S. Food and Drug Administration (FDA) for Zohydro(TM) for Treatment of Chronic Pain More...

• Janssen Research & Development Submits XARELTO® (rivaroxaban) to U.S. FDA for the Treatment and Prevention of Recurrent Venous Thromboembolism More...

• A Woman's Intense Interest in Her Partner Shifts When Grandchildren Arrive,University of Oxford Study More...

• Fish Oil Doesn't Cut Failure Rate of Hemodialysis Grafts, Lawson Health Research Institute Study More...

• Computer Use and Exercise Combo May Reduce the Odds of Having Memory Loss, Mayo Clinic Study More...

• Vitamin D Blood Level for Reducing Major Medical Risks in Older Adults Identified, University of Washington Study More...

• Advanced Cell Technology Announces Massachusetts Eye and Ear as Additional Site for Clinical Trial for Dry Age-Related Macular Degeneration Using Human Embryonic Stem Cell-Derived RPE Cells More...

• Biodel Inc. (BIOD)'s Intellectual Property Position Strengthened for Ultra-Rapid-Acting Insulin Programs by Notice of Intent to Grant from European Patent Office More...

• Entia Biosciences Launches Medical Food for Treatment of Rheumatoid Arthritis More...

• Bioniche Life Sciences Inc. (BNC) Commercializing Two Products for Canine Cancer More...

At its BlackBerry World conference in Orlando, Research In Motion just released its BlackBerry 10 operating system to developers keen to write apps for the platform, and it also showed "DevAlpha" testbed hardware for the OS--an all-touchscreen smartphone, with a 720p 4.5-inch screen. All approved developers can gain a handset to help them write code using the BB10 developer OS, but because BB10 is still in prototype phase it's incomplete and the newly-released system cannot hook up to Wi-Fi or make phone calls. BB10 and the touchscreen devices it'll run on represent RIM's hope at inserting BlackBerry's once again into the leading edge of smartphone tech--though early opinions on the software are somewhat lacklustre, and again lead to doubts RIM can catch up to Apple, Google and Microsoft, especially as consumer handsets aren't due to later in the year by which time new Apple and Android hardware will have arrived.

NFC and mobile payments really are breaking big... outside the U.S. Credit card company Visa has confirmed launch details of their mobile payment system V.me, first announced late last year. The mobile wallet service will launch in the U.K., Spain and France in August 2012, giving customers, banks and retailers access to multiple cards through a smartphone, computer, or tablet. "V.me sits at the heart of Visa’s future of payments," Mariano Dima, Executive Vice President of Product and Marketing Solutions at Visa Europe said in a release, adding that the service would be a "streamlined online checkout experience" and offer users "the same protection and rights that come with any Visa card transaction." Visa is gearing up for more change too--Dima added that "V.me will ultimately be able to incorporate any or all of our new payment technologies, allowing our members to deliver the best possible payments experience whether face-to-face, online or in a mobile environment." In the U.K., Visa will be partnering with payments processors WorldPay.

By Satyajit Das, derivatives expert and the author of Extreme Money: The Masters of the Universe and the Cult of Risk Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives – Revised Edition (2006 and 2010). Jointly posted with Roubini Global Economics

The half-life of solutions to Europe's debt problem is getting ever shorter.

Recent hopes have relied on the ostensible success of the European Central Bank's ("ECB") LTRO – Long Term Refinancing Operation, more appropriately termed the Lourdes Treatment and Resuscitation Option. In December 2011 and February 2012, the ECB offered unlimited financing to European banks at 1% for 3 years, replacing a previous 13-month program. Banks drew over Euro 1 trillion under the facility – €489 billion in the first round and €529.5 billion in the second. Participation amongst European banks was widespread, especially in the second round where around 800 banks used the facility.

The funds borrowed were used to purchase government bonds, retire or repay existing more expensive borrowings and surplus funds were redeposited with the ECB. The first entailed banks borrowing at 1% purchasing higher yielding sovereign debt, such as Spanish and Italian bonds that paid 5-6%. This allowed banks to earn profits from an officially sanctioned carry trade – known as the Sarko trade after the French President.

The LTRO provided finance for both beleaguered sovereigns and banks, which need to raise around €1.9 trillion in 2012. It helped reduce interest rates for countries like Spain and Italy. It also helped banks covertly build-up capital, via the profits earned through the spread between the cost of ECB borrowings and the return available on sovereign bonds.

The LTRO was very clever, effectively monetising debt (printing money) without breaching European Treaties or the ECB's charter.

The sheer weight of money – at one €500 note per second it would take 63 ½ years count €1 trillion- proved successful. Financial market sentiment was overwhelmingly positive feeding a large rally in global stock markets and other risky assets.

As subsequent events have exposed, there were always reasons to be cautious.

The LTRO facility is for 3 years. It assumes that the conditions will normalise within that period. It is not clear what happens if that is not the case.

Economist Walter Bagehot advised that in a crisis central banks should lend freely but at a penalty rate and secured by good collateral. The ECB does not appear to have quite understood Bagehot's commandment. The rate is below market rates, amounting to a subsidy to banks. The ECB and Euro-Zone central banks have loosened standards, agreeing to lend against all manner of collateral. In effect, the ECB is now functioning as a financial institution, assuming significant credit and interest rate risks on its loans.

If the European Financial Stability Fund ("EFSF") was a Collateralised Debt Obligation, the ECB increasingly resembles a highly leveraged bank.

The ECB balance sheet is now around €3 trillion, an increase of about 30 percent just since Mario Draghi took office in November 2012. It is supported by it own capital (scheduled to increase to €10 billion) and the capital of Euro-Zone central banks (€80 billion). This equates to a leverage of around 38 times.

Critically, the LTRO cannot address fundamental issues.

It does not reduce the level of debt in problem countries, merely finances them in the short-run. Europe is relying on its austerity program to reduce debt. As Greece demonstrated and Ireland, Portugal, Spain and Italy are demonstrating, massive fiscal tightening when combined with private sector reduction in debt merely puts the economy into recession. As public finance deteriorate rather than improve, it results in an increase not decrease in public debt.

Ultimately, it may be necessary to go Greek. Debt restructuring may be needed to achieve the required reduction in the public borrowings for many countries. Interestingly, financial markets price the risk of a Spanish debt restructuring at around 30-35%.

The LTRO does not improve the cost or availability of funding for the relevant countries beyond an immediate short term fix..

Government bond purchases financed by the LTRO artificially decreased the interest rates for countries, such as Spain and Italy. Unless additional rounds of LTRO are offered, interest rates are likely to return to market levels.

The real increase in liquidity available to support sovereign borrowings was lower than €1 trillion. Perhaps only one third of the LTRO loans and maybe as little as €115 billion were directed to this purpose. Banks used the bulk of funds to repay their own borrowings. As debt becomes due for repayment through the year, banks may need to sell sovereign bonds purchased with the funds drawn under the LTRO. Unless market conditions normalise and banks regain access to normal funding quickly, this will place increasing pressure on sovereign funding and its cost.

With European countries facing heavy refinancing programs in 2012 and beyond, the ability to raise funds at reasonable rates remains important. Existing bailout programs assume countries like Portugal and Ireland will be able to resume financing in money markets normally from 2013.

Events complicate the ongoing commercial financing of European banks and sovereigns. The need for collateral to support ECB funding makes other investors de facto subordinated lenders, reducing their willingness to lend or increasing the cost. In the Greek restructuring, European Central Banks and official institutions were exempted by retrospective legislation from loss while other investors suffered 75% writedowns. This has reduced investor willingness to finance countries considered troubled.

European banks already have large exposures to sovereign debt, which has increased since the start of the LTRO. Spanish banks are thought to have purchased around €90 billion, a jump of around 26% to €220 billion. Italian banks are thought to have purchased €50 billion, a jump of 31% to €270 billion.

Similar rise in government bond holding have occurred in Portugal and Ireland. As interest rates on these bonds have increased, buyers now have large unrealised mark-to-market losses on these holdings.

As with the sovereigns, the LTRO does not solve the longer term problems of the solvency or funding of the banks, which now remain heavily dependent on the largesse of the central banks. It is government sponsored Ponzi scheme where weak banks are supporting weak sovereigns who in turn are standing behind the banks – a process which can be best described as two drowning people clinging to each other for mutual support.

The LTRO has not materially increased the supply of credit to individual and businesses. The money is being used by banks to finance themselves as they reduce borrowings by selling off assets to reduce dependence on volatile funding markets. The LTRO does little to promote desperately needed economic growth in the Euro-Zone.

The initial euphoria faded as a number of concerns re-emerged, manifesting themselves in the form of increasing rates on Spanish and Italian debt which now hover around the key level of 6.00% per annum.

Increasingly poor economic growth figures from Europe pointed to a lack of growth and progress on debt reduction.

Attempts to reduce Spain's deficit has proved problematic. Both Spain and Italy have deferred balancing their budget in the face of a deteriorating economic outlook. It is unclear which markets fear most -Spain and Italy not achieving its targets through savage spending cuts resulting in higher debt or achieving its target putting their economies into an even deeper recession and increasing debt.

The difficulties faced by Spanish Prime Minister Mariano Rajoy and Italian Prime Minister Mario Monti implementing labour reforms have highlighted the resistance to structural change. Increasing protests in many countries point to the political difficulty in implementing the agreed austerity measures.

The problems of the banking system have resurfaced. Spanish bank bad and doubtful debts have increased, as the Iberian property bubble deflates.

Increased reliance by Spanish and Italian banks on financing from central banks has heightened concern. Spanish bank borrowings from the ECB increased to over €300 billion in March from €170 billion in February. Lending to Spanish banks now accounts for nearly 30% of total ECB lending. Italian banks have also been heavy borrowers, a reminder of the linkage between banks and their sovereigns.

Reluctance to increase the inadequate European firewall sufficiently to deal with potential problems means policy options are limited. At around €500 billion in available funds, the bailout fund is short of the €1 trillion sought by the International Monetary Fund and G-20 or €2-3 trillion thought necessary by financial markets. German leaders have repeated their unwillingness to increase the fund to the necessary size, arguing, probably correctly, that no firewall will be adequate.

Poorly judged and ill-timed comments by ECB President Draghi about the absence of need for further LTRO funding and planning for an exit drew attention to the fragility of the position and ongoing risks. The comments were driven by Bundesbank unease at the ECB's policy. The market reaction forced Mario Draghi to retract comments about an early exit from emergency funding. As rates continued to rise, Benoit Coeure, the French ECB board member, promoted a new round of direct purchases of Spanish bonds to reduce yields.

The failure of the LTRO to decisively solve European problems is unsurprising. Confidential analyses prepared by European Union officials and distributed to ministers meeting at the Copenhagen meeting in March 2012 concluded that the €1 trillion in loans was a "reprieve", rather than a solution.

Rather than take the time afforded to move on other fronts, European leaders reverted to type. Spanish Finance Minister Luis de Guindos opined that: "We are convinced that Spain will no longer be a problem, especially for the Spanish, but also for the European Union". It was eerily reminiscent of his predecessor Elena Salgado who almost exactly one year earlier on 11 April 2011 said: "I do not see any risk of contagion. We are totally out of this". The optimism was echoed by French President Nicolas Sarkozy who was confident that the Euro-Zone had "turned the page". Italian Prime Minster Mario Monti stated that the "financial aspect" of the crisis had ended.

The European debt crisis is not over. Fundamental problems – debt levels, trade imbalances, problems of the banking sectors, required structural reforms, employment and economic growth – remain.

Beyond the German favoured remedy of asphyxiating austerity to either cure or kill the patient, Europe is rapidly running out of ideas and time to deal with the issues. As the real economy stalls and debt problems continue, the most likely policy actions may come from the ECB – an interest rate cut to near zero and further liquidity support, perhaps even full-scale quantitative easing. Bailout funds may be channelled to recapitalise Spanish banks, as means of helping Spain without resort to a full-blown bailout package.

It is doubtful whether any of these steps will work.

European politicians and citizens want a quick return to a period Spaniards now refer to ascuando pensábamos que éramos ricos which translated into "when we thought we were rich". Official policies and action are focused on deferring rather than dealing with the problem. Unfortunately, that means the inevitability of meeting the same problem somewhere down the road.

John Maynard Keynes observed in The Economic Consequences of the Peace that each action designed to bring closure to one crisis sows the seeds of greater economic, political and social problems. Europe is living the truth of that statement one day at a time.